- 2 Minute Read

- 28th February 2020

London’s Growing Flex Appeal - Report

New report reveals that the Central London flexible office market is thriving.

- Central London is now home to more than 850 flexible office locations

- Central London’s flexible office locations have grown by 34% year on year

- There are now over 300 flexible workspace operators in Central London

- Enquiries for larger flexible office space are growing. 35% of enquiries were for 10 desks or more.

Our new Central London market report suggests a continued growth within flexible office spaces, a growing trend which shows no sign of slowing. Flexible workspaces have seen a dramatic increase in recent years, with Central London at the forefront of this growth.

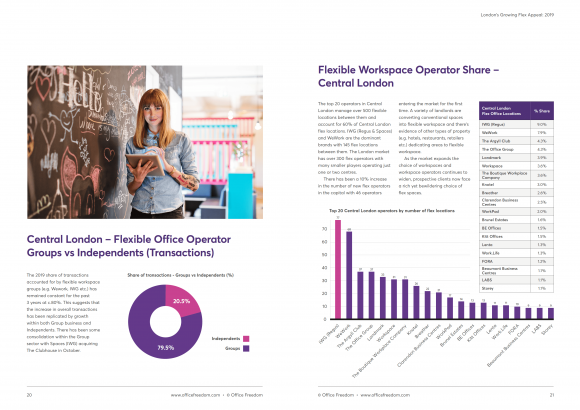

The “London’s growing flex appeal” report takes a detailed look at Central London flexible workspace trends. It reveals the City of London holds a 22.2% share of flex working spaces, Tech City (Shoreditch, Old Street and surrounds) holds an 11.9% share and Midtown (Bloomsbury, Holborn and surrounds) holds a 10.9% share. While the City of London was the single area in which most transactions were concluded, the locations covered by the W1 Postcode (Mayfair, Marylebone, Soho, Fitzrovia etc.) accounted for the majority of flex office transactions.

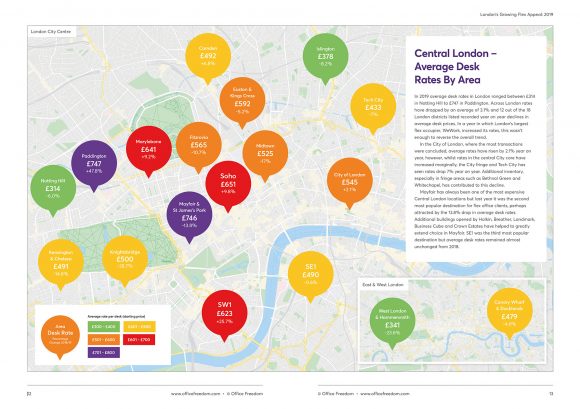

In 2019 the average London monthly desk rates ranged from between £314 in Notting Hill to £747 in Paddington, with London rates having dropped an average of 3.1% year on year. Historically Mayfair has been one of the most expensive Central London flex locations; however, with a 13.8% drop in average desk rates it has become the second most popular destination for flex offices behind The City. SE1, the third most popular location, has seen little change in average rates.

“Despite the political and economic uncertainties of Brexit, the flexible office market in Central London has been thriving. Throughout 2019 we have seen sharp increases in supply and demand, the report shows that a new Central London flex space was added to our portfolio every 1.7 days last year.” – says Richard Smith – CEO and Founder Office Freedom.

The growing demand for flexible working spaces can widely be attributed to the Tech industries, with the sector accounting for 16.3% of all flexible office transactions in 2019- double that of 2018. Finance companies hold the second largest share of flex-spaces, with a 12.7% market share; much of this can be linked to London’s continuing global financial influence as the second highest rated financial hub. Companies with a technology focus continue to drive demand in the flex office market but more traditional sectors such as Legal and Health are also investing in flex space

The future of the flex space market is predicted to see a continuing increase, with a variety of sectors beginning to, and continuing to use, flexible working spaces.

Kevin Tewis-Allen, CMO of Office Freedom predicts- “With UK economic and political volatility easing post-Brexit, we expect that global investment into the London flex market will rise substantially. We anticipate seeing increasing demand from sectors such as insurance, banking, legal and new tech industries like fash-tech (fashion technology)” .

Download the full report here.