- 10 Minute Read

- 17th July 2023

The Top 20 Serviced Offices in London to Rent in 2024

London is home to globally-recognised financial leaders, corporate banks, tech titans, and insurance giants, so there’s no wonder businesses want to associate themselves with this eponymous metropolis. As such, it has become a hub for serviced office space, beholding an array of offices for businesses of all sizes and styles to call home.

The serviced office style continues to gain popularity, overtaking that of the traditional leased office. Businesses are charmed by the lower costs, flexible terms, fully-furnished workspaces, Plug’n’Play solutions, and all-inclusive pricing. And, with so much effort being put into providing a space that fosters collaboration and well-being, serviced offices are expected to be in high demand.

So, if you’re looking for an unparalleled entrepreneurial atmosphere and endless professional opportunities, then take a look at our top 20 serviced London offices that have businesses hooked.

What are the Best Areas for a Serviced Office in London?

Each area and district of London has its own singular offerings which continue to attract businesses from all corners of the globe. From the creative buzz of Soho to the financial world of Canary Wharf, the metropole offers endless diversity and choices for office space.

If you’re looking to be in the heart of the city then Liverpool Street is a great office location. There’s a huge range of serviced offices and coworking options to choose from and the area is home to media companies, developers, and tech businesses.

Holborn, on the other hand, is often referred to as London’s Midtown. It’s a perfect location for businesses looking for a space to grow with them. With offices providing comfortable and inspiring communal spaces, businesses will find comfort and inspiration in Holborn.

If transport links are important, then the inner city has become increasingly popular since remote working has become a normality for businesses. The convenient transport links that come with being located by Kings Cross and St. Pancras have proven essential for businesses with commuting colleagues and international clients.

Alternatively, if you’re looking to establish yourself in the Captial, then a prestigious business such as Mayfair will speak volumes. The area is easily accessible by public transport and with a wealth of networking opportunities around, having a Mayfair office space leaves you in great company.

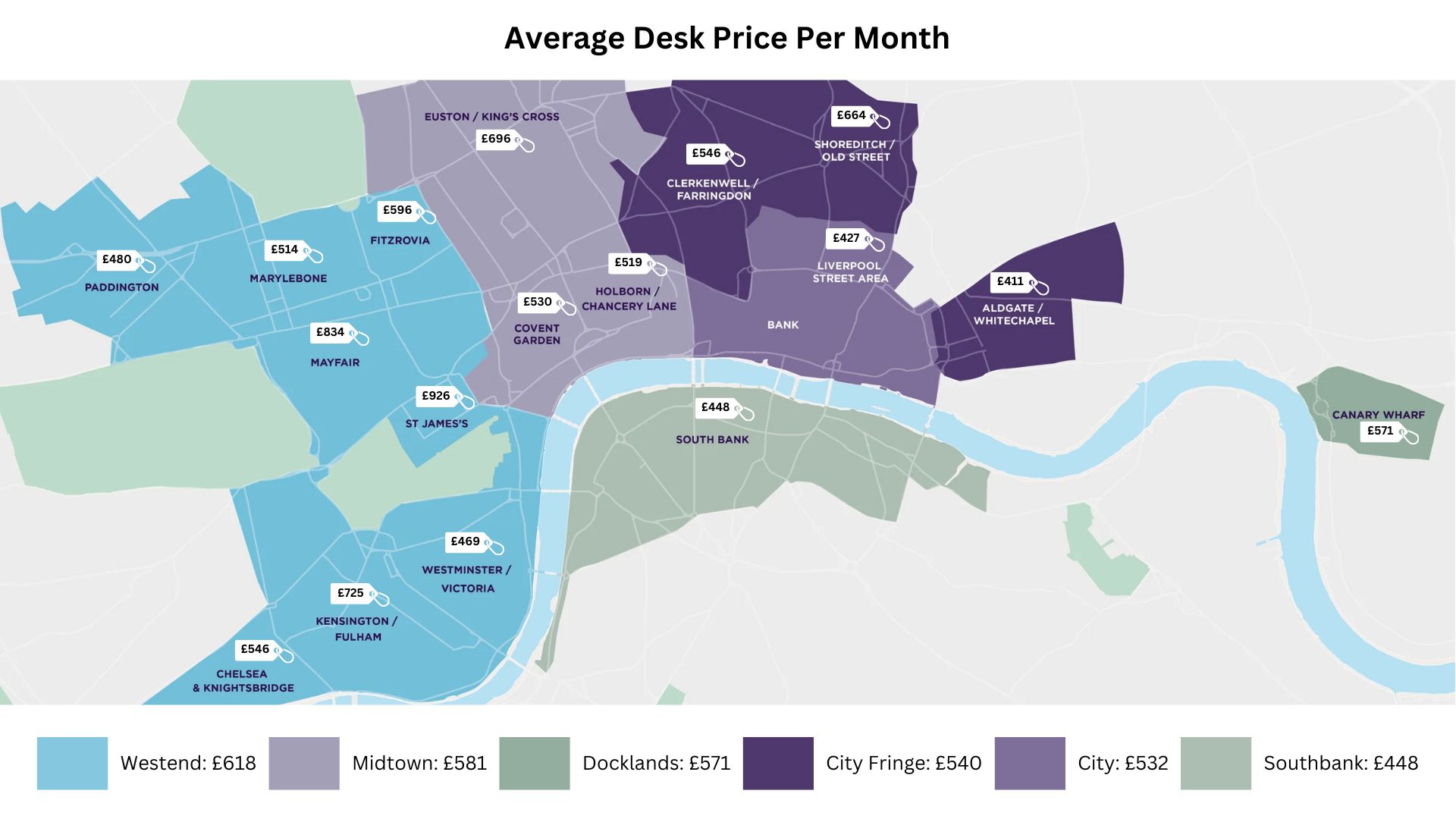

How Much Does a Serviced Office Space in London Cost?

The cost of serviced office space in London varies depending on the area you are looking to rent in. Here are some of the most popular areas businesses rent office space in London and the average cost to rent, per person, per month:

For more information on the cost of office spaces in London, you can read our report on London's Flexible Office Market: A detailed report on prices, trends and usage insights.

Top 20 Serviced Office Spaces in London

Fewer businesses are confident or comfortable signing long-term conventional leases and are therefore seeking flexibility above all. With serviced office spaces in London, you get a contract that suits your terms, fully furnished spaces, and no upfront costs. In no particular order, here’s a list of our top 20 serviced office spaces in London:

1. The Bower - 207 Old Street, EC1 - Old Street

Located in the iconic Tower of Old Street, beyond The Bower is nestled in one of London's most notable edifices, The Bower Quarter. Its prime position situates it at the heart of Silicon Roundabout, the epicenter of London's tech industry.

The building sports a modern aesthetic with a glass façade that soars into the sky. The interior is expansive and luminous, boasting neat and stylish decor with an open-plan layout. Equipped with a top-tier workspace app for navigating the facilities, the community team is always on hand to provide support with any requirements. Occupying two exclusive floors within The Tower, beyond The Bower can accommodate up to 400 desks and offers flexible agreements.

Find out how to rent office space at beyond The Bower, Old Street

2. Landmark Plc - Heron Tower - 110 Bishopsgate, EC2 - Liverpool Street

The Heron Tower welcomes visitors with an imposing triple-height arcade entrance, home to Europe's largest privately-owned aquarium. Landmark's private offices in this iconic skyscraper are meticulously crafted to ensure teams can be productive from day one.

At 110 Bishopsgate, they offer a hassle-free solution that includes all the anticipated services, plus several additional benefits, in one flexible agreement. These benefits encompass local IT support, bike racks, breakout areas, kitchen facilities, and meeting rooms.

Find out how to rent office space at Landmark, Liverpool Street

3. FORA Space - Chancery House, Chancery Lane, WC2 - Holborn

If there's an office that can instill a sense of calm immediately, it's this one. With wellness in mind, the aesthetically pleasing, amenity-rich, campus-style office space is sure to impress.

Set in a beautifully restored historic building, this premium workspace is committed to sustainability, having saved tons of embodied carbon and reduced waste sent to landfills. Just a minute from Chancery Lane tube station, this property features eclectic designs and best-in-class amenities.

Find out how to rent office space at Fora, Chancery Lane

4. Runway East - 20 St Thomas Street, SE1 - London Bridge

Runway East is a contemporary office space situated just one minute away from London Bridge Station and Borough Market. This incredible workspace features all-inclusive office spaces, fully-furnished breakout rooms, private meeting suites, dedicated phone lines, the latest technology, and high-speed internet. All this is available in a stunning Georgian period building in the London Bridge Quarter district.

Find out how to rent office space at Runway East, London Bridge

5. FORA Space - 33 Broadwick Street, W1 - Soho

Fora is located in the heart of Soho. Residents of this refurbished modern building enjoy access to high-end furnishings throughout and luxurious facilities including breakout spaces, private meeting suites, as well as a “pro-working” area where companies can work collaboratively in a vibrant setting. There’s even a recording studio on site for professional content production.

Find out how to rent office space at Fora, Soho

6. Lentaspace - Thanet House - 231-232 The Strand, WC2 - Strand

Thanet House boasts a captivating traditional, period exterior and a beautiful interior to match. The result is a charming and inspiring work environment for all teams. The office is situated on one of London’s most prominent street addresses, the Strand, which opens businesses up to a wealth of networking opportunities.

Find out how to rent office space at Lentaspace - The Strand

7. Work.Life - 33 Foley Street, W1 - Fitzrovia

Nestled on alluring Foley Street, Fitzrovia offers a serviced office space that is captivated by fragrant greenery and exposed, warm red bricks. The characterful office space entices businesses not least for its vintage aesthetic but also its practical use of space, flexible access, video conferencing facilities, and creative design. It is the perfect blend of West End character and East Side bustle.

Find out how to rent office space at Work.life, Fitzrovia

8. Halkin Business Centres - 10 Lower Thames Street, EC3 - Monument

Halkin Business Centre overlooks the River Thames and will give its lucky residents an endless view of the Capital’s identifying skyline. Situated in Monument, this serviced office space offers a 21st-century design with all the trimmings. Benefit from private meeting suites, breakout spaces, conference rooms, an on-site gym, and a fully furnished roof terrace.

Find out how to rent office space at Halkin, Monument

9. WeWork - 2 Southbank Place - 10 York Road, SE1 - South Bank

This serviced space in South Bank houses businesses of varying sizes and types. The flexible lease options enable companies to choose a space that perfectly suits their brand requirements, whether you’re looking for inspiring coworking spaces, private meeting suites or relaxed breakout spaces. Southbank Place also ranks high for its strong transport connections and surrounding amenities.

Find out how to rent office space at wework, South Bank

10. Ocubis - City Pavilion -27 Bush Lane, EC4 - Cannon Street

Pavilion earns its place on our list due to everything from the appealing exterior to its expertly designed coworking facilities. The building goes above and beyond to offer residents stunning office spaces that are suitable for almost all requirements. With high-speed internet, dedicated phone lines, the latest business technologies, private meeting suites, a rooftop terrace, and more, you have a first-class serviced office space.

Find out how to rent office space at Ocubis, Cannon Street

11. BE - Business Environment Minories Ltd -150 Minories, EC3 - Minories

Located deep inside the Capital’s insurance hub, BE offices have it all from networking to onsite facilities. This office location in Aldgate provides a whole host of amenities including executive conference rooms, relaxing breakout spaces, meeting suites, coworking areas and a list of surrounding eateries to entertain colleagues and clients alike.

Find out how to rent office space at BE, Minories

12. The Office Group (TOG) - Gridiron Building - 1 St Pancras Square, N1 - Kings Cross

Two floors of enchanting office space occupy this Kings Cross location. The iconic Gridiron building offers a host of facilities including a drop-in lounge, event space, conference rooms, breakout spaces, and a professional on-site team ensuring your business is fully equipped to succeed. What’s more, you get a one-of-a-kind view overlooking Kings Cross and St Pancras station, not only appealing to the eye but perfect for commuting colleagues and visiting clients.

Find out how to rent office space at The Office Group, Kings Cross

13. One Avenue Group Limited- 64 North Row, W1K - Mayfair

This Mayfair workspace has been recently transformed into one of London’s most-desirable office spaces. With a VIP lounge, afternoon tea service, a dedicated concierge, state-of-the-art technology, modern meeting rooms, private chat booths, and breakout spaces, North Row exceeds serviced office expectations in abundance.

Find out how to rent office space at One Avenue, Mayfair

14. IWG (Signature) - 100 Bishopsgate, EC3 - Liverpool Street

Strategically positioned in the center of London’s financial district, this unique centre is divided across the Bishopsgate Tower and St. Helen’s Place. The building sits within view of the iconic Gherkin and features a selection of high-quality services, including private meeting rooms, breakout spaces, coworking areas, and on-site staff to help you with your daily needs.

Find out how to rent a serviced office space at IWG, Liverpool Street

15. Landmark - 111 Park Street, W1 - Mayfair

Mayfair’s Landmark exudes refinement, prestige, and charm. The building has been thoroughly overhauled to provide its residents with the best quality workspaces possible. Businesses will enjoy naturally light offices, collaborative workspaces, a modern rooftop terrace, breakout spaces, private meeting suites, and much more. You also get free hot drinks and snacks each day to keep your productivity fuelled.

Find out how to rent a serviced office at Landmark, Mayfair

16. LABS - 90 High Holborn, WC1 - Holborn

Located in Holborn, LABS is amongst London’s most high-end office spaces that any business would be proud to call home. Only a five-minute walk from Holborn Station, this space offers everything from stylish and fully furnished private suites to collaborative and atmospheric coworking areas. Other facilities include a cafe, bar, restaurant, breakout spaces and a large event space.

Find out how to rent a serviced office at LABS, Holborn

17. Bourne Office Space - 70 Pall Mall, SW1 - St James's

If you are looking for an office space with a fine pedigree, then this Bourne business centre is for you. Set within prime St James’s, this office space boasts impressive amenities including a business lounge, breakout spaces, private meeting suites, coworking areas, and the latest in business technologies, so you have the necessary foundations to succeed.

Find out how to rent a serviced office space at Bourne, St James's

18. The Space - 14 New Street, EC2 - Liverpool Street

The Space is designed to melt away the city's hustle and bustle as soon as you step inside. Find yourself enveloped by an airy atmosphere and an art deco interior. Features of this office space include generously sized offices, open-plan spaces for collaborative work, breakout rooms, private meeting suites, bike storage, and more. Located next to Liverpool Street station also means you’re well connected to the rest of the city.

Find out how to rent a serviced office space at The Space, Liverpool Street

2. Mindspace - Metro Building, 1 Butterwick, W6 - Hammersmith

If your business requires open-plan office space, then Mindspace is for you. Located in Hammersmith, this business centre provides shared or dedicated desks for freelancers, solo entrepreneurs, remote employees, and travelling professionals. There’s also a selection of private office space too giving businesses the flexibility to choose their own team suite. You’ll also benefit from breakout spaces, meeting rooms, and the latest technology.

Find out how to rent a serviced office space at Mindspace, Hammersmith

20. Orega - 70 Mark Lane, EC3R - Fenchurch Street

Orega sits just opposite Fenchurch Street Station and is surrounded by some of London’s most iconic buildings. This office location makes an instant impression with its sleek design and state-of-the-art amenities that meet the needs of multiple business types. You’ll have access to a meeting room, breakout spaces, coworking areas, and an on-site kitchen, all making it a prime office location.

Find out how to rent office space at Orega, Fenchurch Street

There it is. Our selection of the top 20 serviced offices in London - 2021. To help you find the perfect office for your business, we have answered a small selection of frequently asked questions to help you get started. Click the links below to reveal the answers.

Serviced Offices in London - Frequently Asked Questions

- Where can I find serviced offices in Central London?

- Where can I find serviced offices in North London?

- Where can I find serviced offices in South London?

- Where can I find serviced offices in East London?

- Where can I find serviced offices in West London?

- What’s the difference between serviced and leased offices in London?

- How much do serviced offices in London cost?

- Why should I use a broker to find a serviced office in London?

- Where can I find short-term office space to rent in London?

- What should I look out for when choosing office space in London?

- Where can I get expert advice on how much office space I need?

Do You Need Help Finding a Serviced Office in London?

If these offices aren’t exactly to your taste, fret not, we have hundreds more serviced offices in London in our portfolio for you to choose from. You can also browse our entire selection of rented, coworking, corporate, and flexible office spaces too.

For the latest pricing, promotions, and availability, contact Office Freedom today and get your office space search underway. Email [email protected]